Industry weighs in on new legislation aimed at Google

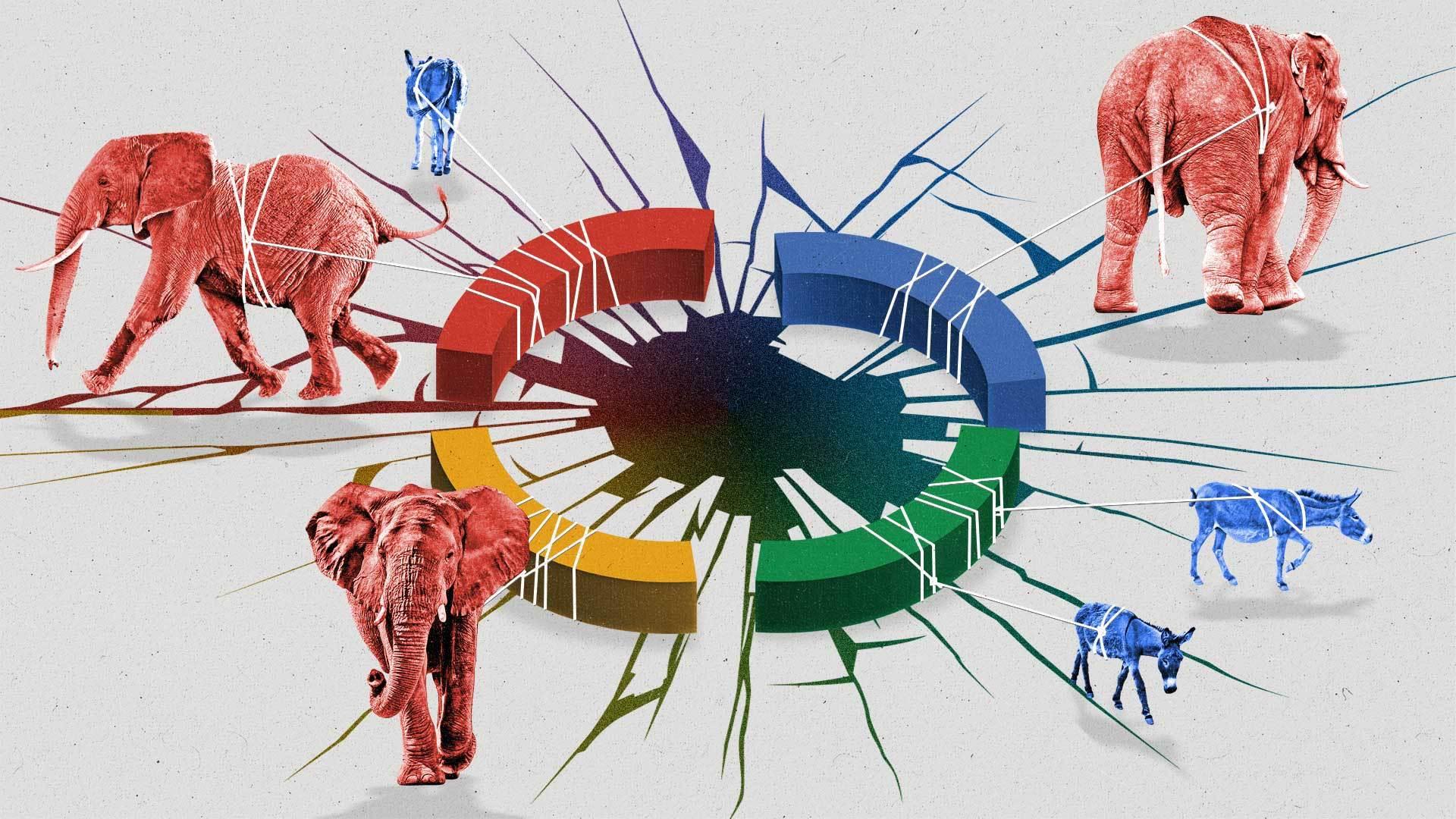

Fear of Google’s oversized influence on digital media has made for strange political bedfellows.

Last week, Americans discovered the one thing that can bring Sens. Ted Cruz (R-Texas) and Amy Klobuchar (D-Minn.) together: legislation seemingly aimed at breaking up Google.

Those two, along with Sen. Richard Blumenthal (D-Conn.), co-sponsored a bill introduced last week that would forbid companies that process more than $20 billion per year in digital advertising transactions from operating more than one aspect of the ad tech supply chain, language that takes direct aim at Google.

“[Breaking up Google] would be great across the board,” Cory Doctorow, special advisor at the Electronic Frontier Foundation, a nonprofit focused on digital civil liberties, told The Current. “You would have more competition in the ad tech industry and better consumer rights protection, assuming the bill is well written and not filled with junk.”

The new move comes as legislators take a closer look at the mechanics of the digital media industry. Ad tech companies typically operate either as buyer solutions, such as demand-side platforms (DSPs), which help brands and agencies purchase ad inventory, or as seller solutions, such as supply-side platforms (SSPs), which help publishers optimize ad revenue. Google has ad tech solutions that operate on both sides of a transaction — an inherent conflict of interest that stifles competition in the industry, according to some lawmakers.

Earlier this year, an amended antitrust complaint alleged Google colluded with rival Facebook to limit competition in the online advertising market. According to the complaint, Google tried to convince Facebook to support Google Open Bidding, the company’s answer to header bidding, a practice that allows publishers to receive the best possible bid on their ad inventory without having to use Google’s ad tech infrastructure.

Open Bidding has been criticized for giving Google control over both sides of an advertising transaction and not providing transparency to both buyers and sellers. As such, DSPs like The Trade Desk have banned Open Bidding from their platforms.

Google has defended its ad tech practices, saying breaking up its ad tech business would “hurt publishers and advertisers, lower ad quality, and create new privacy risks.”

Jason Kint, CEO of Digital Content Next, a trade organization representing digital publishers, poked holes in that defense on Twitter, noting that ad tech is a significant revenue stream for Google and criticizing the company’s stranglehold on the industry and consumer data.

to believe G here, you need to believe more competition will result in less privacy and lower ad quality. In other words, one supreme leader with all of the data can protect you best. This is false. G's market power and surveillance actually force bar lower for everyone else. /5

— Jason Kint (@jason_kint) May 20, 2022

It’s too early to tell whether the most recent legislation will become law, Doctorow says, but the early bipartisan support is positive. “There are sizable pluralities in the Republican and Democratic caucuses who, based on what they’ve said, would likely support it,” he says.

Subscribe to The Current

Each week, The Current gives you a rundown of the biggest stories and latest trends from the world of data-driven marketing, including topics like Connected TV and the future of identity — all delivered directly to your inbox.