Aussie TV networks eye strategic investments to capture streaming’s audience boom

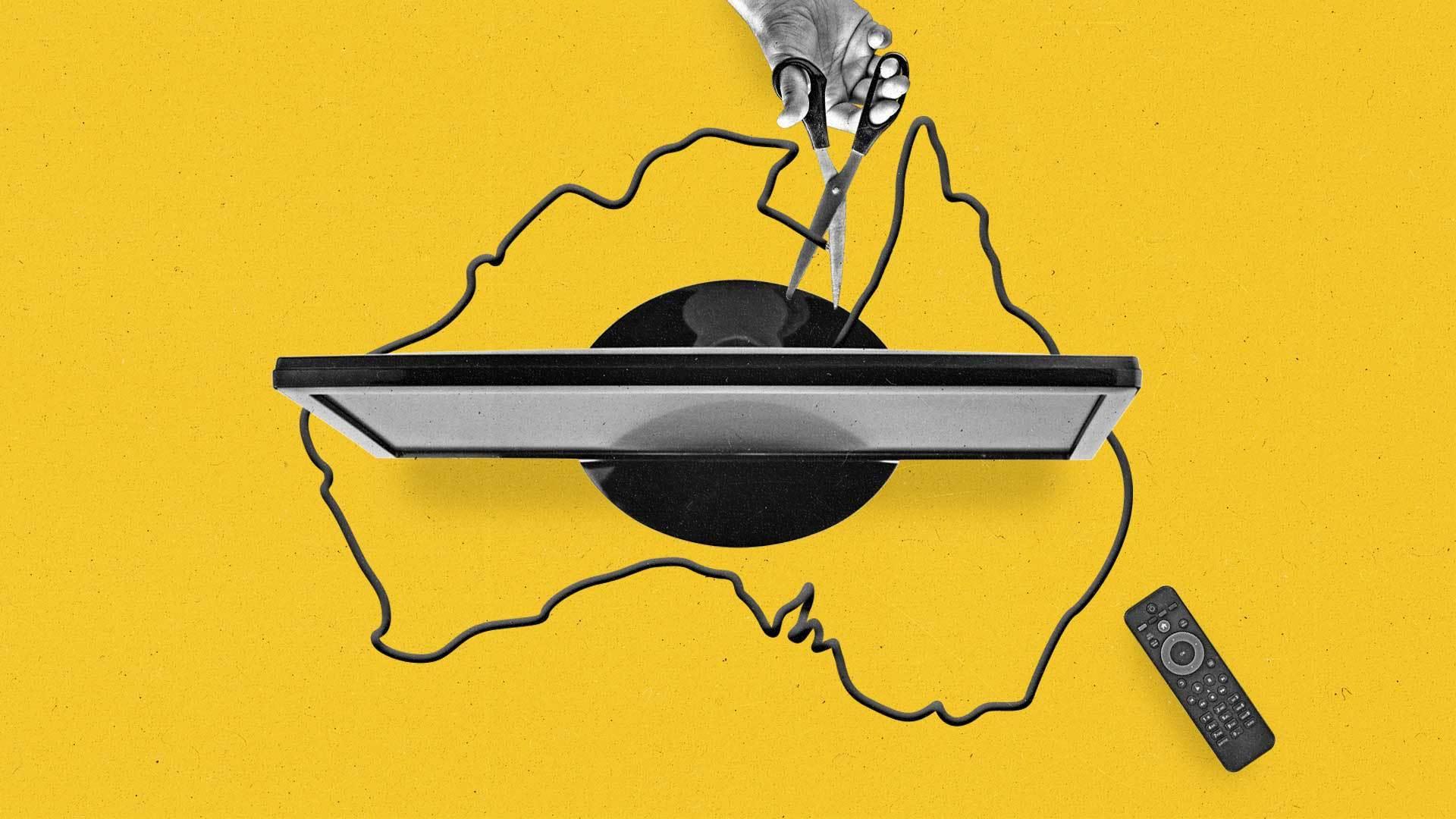

Media continues to see rapid audience and advertising growth in connected television (CTV) in 2023, as consumption shifts to digital with the supercharged growth of video on demand.

Traditional linear TV viewing, while still relevant in the Australian market, is on the decline, according to ThinkTV. Australians have changed the way they watch big-screen content, and advertising is adapting to keep up, creating a range of new opportunities for marketers.

To capture the attention of this growing audience, Australia’s major TV networks Seven, Nine, and Ten are bolstering their own broadcast video on demand (BVOD) platforms, 9Now, 7Plus, and 10Play. They’re enhancing both the user experience and ad experience, signaling that these ad-funded streaming tiers are critical to future profitability.

Strong focus on the UI/UX experience

“Audiences are increasingly in the driver’s seat on our digital channels, interacting with ads and selecting their interests, so those experiences have to be relevant, creative, timely, and targeted to motivate audience engagement,” Shani Kugenthiran, digital advertising strategy and product director at Ten, tells The Current.

The user experience on connected TVs starts as soon as they turn them on, adds Rod Prosser, the chief sales officer at Ten. “The network has developed ‘innovator ad products’ to integrate the ad experience more seamlessly,” he says. “For example, personalized ads that are relevant to the viewer’s interests and preferences. The ads are integrated into the content, so they don’t interrupt the viewing experience. Additionally, users can skip ads or watch them later, giving them more control over their viewing experience.”

When relevant ads are integrated into the viewing experience, viewers are less likely to tune out or switch channels, says Prosser. Such personalized ads can lead to higher conversion rates and return on investment for advertisers. Additionally, with the rise of ad-free streaming services, providing a positive ad experience can help maintain the viability of ad-supported models.

“As audiences move into the BVOD ecosystem, TV networks have to gently shift strategy to introduce frequency caps,” says Richard Hunwick, director of sales for Total Television at Nine. “They need to look at profiling viewers to boost user experience and feed recommendation engines, so users are getting a tailored experience.”

Keeping consumer privacy top of mind

The regulation, safety, and use of consumer data is under scrutiny in markets around the world with the ongoing advancements in marketing technology. The existing laws are susceptible to misinterpretation and potential misuse and can result in consumer mistrust. Consequently, there is growing demand for a more robust regulatory framework to safeguard personal information.

Advertising on BVOD may use many first-party data points to let marketers add a layer of relevance to video ad delivery. So, it’s no surprise that TV networks are making consumers’ privacy a top priority, alongside personalization.

Respecting the user and their privacy is the “key to success” and to future-proofing BVOD platforms, says Ten’s Kugenthiran.

“Safeguarding first-party data is crucial for every industry, and of course for us, as a broadcaster, it’s incredibly important because our users need to feel safe coming to our channels and platforms and regularly returning,” she says. “PII [personally identifiable information] is something that we have been focused on and ensuring privacy around.”

What’s next for TV broadcasters in 2023

Quality content is critical to the success of the networks as they expand their distribution. All of them say they’re investing in new content to ensure audiences remain engaged and entertained.

“The multipurposing of the content and the content utilization [...] is front of mind for broadcasters,” says Kurt Burnette, Seven’s chief revenue officer. “How do you make sure that as many people who are passionate about your content get to see it in many ways, whatever they want, wherever they want it?”

Nine’s Hunwick says this year is all about broadcasters meeting consumers where they’re watching and being prepared to tap in to the trends in-market. “I think the growth of live streaming is key,” he says. “What you’re going to see from the Nine over the rest of the year is a big step into interactivity from an advertising perspective, and new innovations come through, things like FAST [free ad-supported television] channels.”

It’s an opportunity, he says, for the network “to build off the base that is linear free-to-air but expand that, and take advantage of the opportunity digital gives that linear doesn’t to enhance the overall product and offering.”

Ten’s Kugenthiran also maintains that broadcasters can’t ignore digital and its growing piece of the “advertising pie.”

“Ultimately, we want to be able to deliver to advertisers and client’s relevance at scale and we want to help them to protect and extend market share, as well as enrich customer understanding,” she concludes.

Subscribe to The Current

Subscribe to The Current