The unredacted Texas-led lawsuit alleges that Google doesn’t play fair

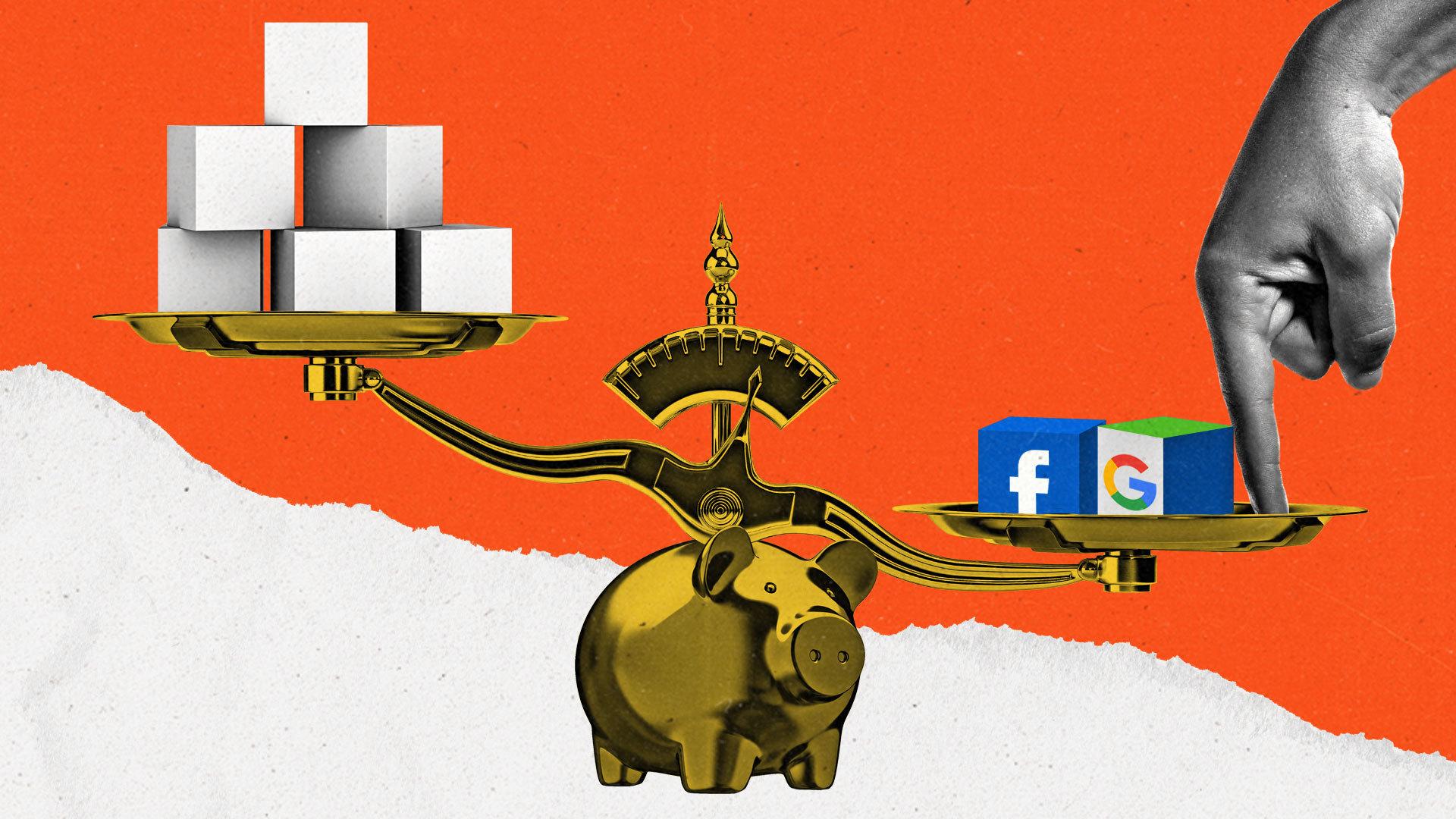

Last weekend’s must-read for tech industry titans was the unredacted 173-page lawsuit by states attorneys general, which alleged that Google uses its monopoly power in online advertising to rig the market and “kill” competition. “The devil is in the unredacted details,” noted Ad Exchanger, including alleged agreement between Google and Facebook codenamed “Jedi Blue.” We’ll get to that.

Meanwhile, many in the ad industry didn’t exactly flinch when the alleged details emerged in the lawsuit. “Advertisers have been feeling a disturbance in the force long before Jedi Blue existed between Google and Facebook,” Jason Prance, VP of strategy at the indie agency SCS, told The Current. “Before this antitrust suit is over, the good publishers will have already started their own first-party driven ad revenue, the better advertisers will have found new ways to reach their audiences, and unsuspecting users will hopefully start to see an improved user experience.”

Google had sought to keep many of these allegations under seal, but a federal judge in New York last week allowed much of the antitrust complaint to be unsealed, which the court claimed was in the public interest.

The antitrust complaint — first filed last year by a multistate coalition led by the Texas Attorney General last year, and which is separate from an antitrust complaint brought by the U.S. Department of Justice — alleges that Google collects “a very high tax of 22 percent to 42 percent of the ad dollars otherwise flowing to the countless online publishers and content producers such as online newspapers, cooking websites, and blogs who survive by selling advertisements on their websites and apps.” According to the lawsuit, these costs are subsequently passed onto the advertisers themselves as well as to American consumers.

The lawsuit claims that Google has extraordinary power in the marketplace, noting the company “operates the largest electronic trading market in existence,” which processes about 11 billion online ad spaces every day through its AdX program. It noted that, at the same time, Google “owns the largest buy-side and sell-side brokers.” One Google employee was quoted in the complaint as allegedly saying, “the analogy would be if Goldman or Citibank owned the NYSE.”

Media coverage of the lawsuit highlighted the allegations that Google attempted to circumvent header bidding, which allows publishers to tender out their inventory to multiple ad exchanges to get the highest bid. The lawsuit alleged that privately Google saw this as an “existential threat” to its own business and said that the company engaged in “creative ways to shut out competition from exchanges in header bidding.”

One of those ways, according to the lawsuit, was an agreement hatched in 2018 with Facebook — codenamed “Jedi Blue” — which “hinged on a deal with Facebook to steer the social network away from joining forces with publishers in header bidding,” noted the Ad Age report on the filing.

Google has said the lawsuit is flawed, claiming it is “riddled with inaccuracies,” a spokesperson for the company stated. “In reality, our advertising technologies help websites and apps fund their content and enable small businesses to reach customers around the world. There is vigorous competition in online advertising, which has reduced ad tech fees, and expanded options for publishers and advertisers.”

Despite these revelations, Alphabet Inc., reported strong third-quarter earnings on Tuesday, as expected, thanks to what the Wall Street Journal called the “red-hot digital-ad market.” The tech giant’s growth has been supercharged by a surge in ecommerce advertisers looking to reach online shoppers, as well as revenue driven by YouTube.